Bodecker Partners´ wind power investment day 2020

Bodecker Partners team_sv

Bodecker Partners team_svHedging strategies in these challenging times, saving value on the elcertificate market, and learnings from our PPA advisory to corporates. These were some of the topics presented and discussed when we, at Bodecker Partners, once again invited our clients and network of wind power investors and project developers to a full seminar- and matching day, this time in a digital format. As usual, planned wind- and solar projects were presented, and investors shared their views on challenges and interests in the Nordic renewable markets.

Last Friday, we welcomed, once again, our clients and network of wind power investors and project developers to a day's seminar and matching event. This year we were happy also to have a solar developer presenting their plans, a sign of these projects now becoming large enough to attract external capital. Despite the digital format, we managed to keep at least some of the, for us, so important informal and open discussion climate. Around 30 participants attended, of which about 50% were project developers of Swedish- and Norwegian wind power, and the other 50% were transaction- and investment managers from various investment companies.

So, which were some of the main take-aways?

Power prices and Revenue Risk Management in challenging times

Gustaf started off by taking us back one year to our last. On that day, he explained to us that "rapid technology shifts and transmission restrictions pose significant downside risk 2020-2025" and warned of increased volatility in SYS spot. I think we can all agree that there was justification for these warnings… Looking shortly ahead this time, he pointed out the continued shift towards price setting by SRMC gas (especially for SE3 and SE4), lack of transport capacity on new cables, and a continued significant, and even further increased, volatility risk on system spot price.

"New production of renewable electricity will need to cover both a strong increase in demand as well as a large phase-out of older production facilities"

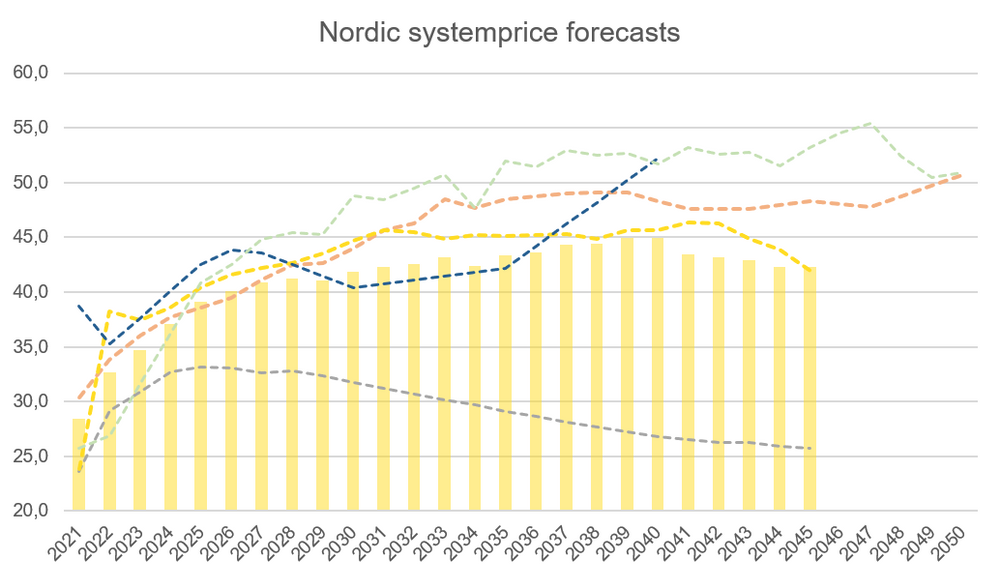

We also had a quick look at what analyst firms believe will be the future Nordic market balance and prices when summarising our assessment of several forecasts made during the year. One clear conclusion is a strong shared belief in rapidly increasing power consumption; ~50-100 TWh by 2040. And from 2040, much power production is phased out. Therefore, new production of renewable electricity will need to cover both a substantial increase in demand as well as a large phase-out of older production facilities.

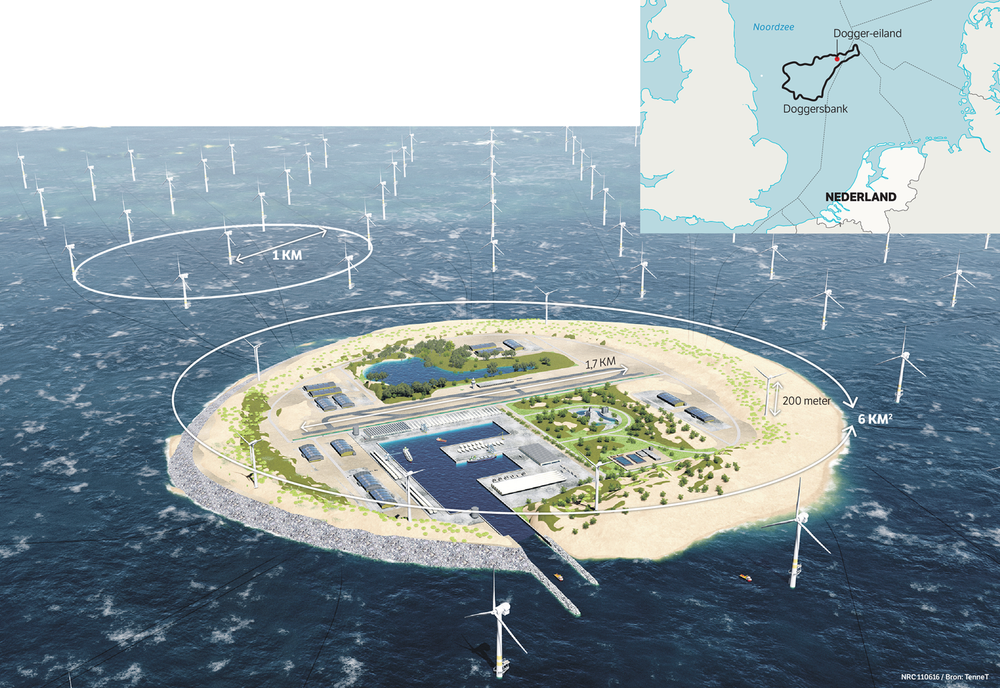

Despite this, the Nordic balance is expected to strengthen towards 40-80 TWh in 2040. Around 10 MW of new interconnection capacity will be built to help exporting this. It is, however, doubtful this capacity can be fully utilised. And we must not forget the energy islands and offshore wind hubs to be built by Denmark, suddenly shortcutting between Sweden/Norway and the continent, competing for export… A potential gamechanger posing downside risk on prices if not balanced by hydrogen production and storage.

Of course, we also discuss the impact of EU ETS and CO2 prices, but we believe this market will lose its effect on Nordic power prices. Development, therefore, becomes less and less important for wind power producers. And this is the million-dollar question. Will marginal cost of coal- and gas production continue to steer Nordic power prices, or will it be LCOE for wind- and solar?

"Will marginal cost of coal- and gas production continue to steer Nordic power prices, or will it be LCOE for wind- and solar?"

Various views on this lead to forecasts spreading from ~30-45 euros by 2030, and ~27-52 euros by 2040. Our view, post-2025, is that LCOE wind will be the predominant price-setting factor, impacted by battery costs and plannable wind.

The Nordic merchant market has been a difficult place for power producers this year. In our session on "Revenue Risk Management," Gustaf shared some insights and learnings on handling risks and hedging wind assets in this market. Bodecker Partners' general risk management philosophy, "Focus on Euros, not megawatt-hours," laid the ground. By showing assets' daily portfolio value (incl. price- and volume risks) compared to expected income in our CTRM system, he discussed how to stay in control and act in time. But what to do when too much value is already lost; "when in trouble, double" or "take the painful pill"?

Corporate PPAs

This year, me and my colleague Sevdie have been involved in corporate PPA decision processes and tenders. Based on this, we shared some of our learnings. Comparing with historical and forecasted prices, a long-term PPA provides, in general, a low cost for consumed electricity. While Nordic power price, by many analysts, is expected around 35-40 euros in 2025-2030 and 40-45 by 2040, PPA price from wind power is often in the range of 30-35 euros. With solar parks, a PPA price of around 35-40 euros is possible.

However, entering into a PPA agreement with a wind- or solar park is more often sustainability-driven; to contribute to renewable energy and climate targets. "Additionality" is wanted, but often even more. Are, for example, some wind parks better environmentally than others? Should parks compensating local community, or providing flexibility solutions, be rated higher in a tender? To have enough time early in the process, for education, to secure support in the organisation, and determine which type of contract is optimal has proven crucial. Unfortunately, we have noticed some branding worries stemming from recent reports and media discussions regarding capacity shortage and closing of conventional power stations. Is there a risk of support for wind power disappearing? We hope this will fade out since much renewable production is needed to cover increased demand, regardless of early phase-out of Swedish nuclear or not.

"A slightly higher price is often better than leaving higher risks"

How can power producers help to make PPAs more available for smaller corporates? Firstly, we would advise making contracts as simple as possible, basing them on consumer profiles, and accepting more risks. A slightly higher price is often better than leaving higher risks. We have also learnt that PPA tenders are possible in public procurement processes, but care must be taken to keep the process very transparent and have details clear in advance.

Electricity certificates, and can we handle the oversupply?

If we move into the electricity certificate world, Sevdie showed us how prices have continued down to 3-4 SEK/certificate. With her daily activity in the market, she has also noted a changed behaviour from buyers where transactions are made more seldom. Market activity varies significantly from week to week, it has become challenging to find buyers, and it essential to capture times when an opportunity opens up.

Wind power now accounts for 65% of monthly issuance of certificates, and the accumulated balance is expected to reach ~6 million by the end of the year. The latest report from the Energy Agency (graph to the left) shows expectations of 62 TWh within the scheme before the now decided stop-date; ~15 TWh above the target.

So, at which point will the costs be higher than than the income, resulting in producers leaving? Is there any way to stop the oversupply from just increasing to unchartered territory? These topics were much discussed, and if you were not there but wish to take part in our thoughts, please reach out to us separately!

Planned projects and investor views

In the afternoon sessions, we had project developers of wind- and solar parks presenting their plans and projects available for investments in the coming years. Due to confidentiality and our agreed "Chatham house rules," I cannot go into any details, but it is evident that the wind power build-out continues also after 2021. Much is planned in price areas SE2 and SE3. However, it was also discussed that permitted projects have been withdrawn by project developers due to limitations on tip height or other technical factors. New applications will be sent in, but this causes delays. This year, we also invited a developer from Finland who described high potential in the country, with good wind locations and low LCOE. We also had the opportunity to hear from a Swedish solar developer presenting "attractive investment opportunities in the next era of renewable energy in Sweden." Rapidly declining costs have led to yearly increases of +60% of solar capacity in Sweden and potential project sizes just above 120 MW. Most is planned in the southern parts of the country, where power prices have been more beneficial.

We ended the day by discussing trends and views with investors active in the Nordic wind market. The overall conclusion is a continued high interest in investing in wind power assets. Solar, battery solutions, etc. are also on the agenda but have so far not been economically feasible. For flexibility solutions to be interesting enough, higher price volatility and/or compensation solutions would be needed. Main challenges described, by both project developers and investors, were the long permission processes and grid connection. Lack of grid capacity was defined as the single largest obstacle. The failure of a stop-mechanism for electricity certificates seems to have hurt the political confidence but will not hinder new investments.

We thank all participants for their engagement and look forward to new discussions and insights next year, hopefully in a "live" environment in Malmö, Sweden.

About Bodecker Partners AB

Bodecker Partners’ expertise within Swedish electricity certificates and carbon emission rights, as well as the Nordic power market, is first-class. We offer independent advisory services to power producers and renewable energy investors in addition to tailored portfolio management services for electricity certificates and carbon emission rights.

Contacts